Easypaisa is a popular mobile money transfer service in Pakistan that has revolutionized the way people handle their financial transactions.

With its easy and convenient services, Easypaisa has become a go-to choice for millions of users across the country.

However, some users may still have questions about certain features, such as the Easypaisa Transaction History Code.

If you are one of them, then this blog post is for you. We will demystify the Easypaisa Transaction History Code and help you understand its purpose and how to use it effectively.

Understanding the Basics of Easypaisa

Easypaisa Transaction History Code: Easypaisa is a leading mobile banking service that offers a broad range of financial transactions directly from your phone.

Launched by Telenor Pakistan in collaboration with Tameer Microfinance Bank, this innovative service provides users the ability to send and receive money, pay utility bills, top-up mobile balance, and much more, without the need for a traditional bank account.

It operates on a simple account setup that can be accessed through USSD codes, a mobile app, or via SMS, making it highly accessible to both urban and rural populations.

This flexibility and ease of use have made Easypaisa a pivotal tool in Pakistan’s move towards digital financial inclusion.

What is the Easypaisa Transaction History Code?

The Easypaisa Transaction History Code is a unique feature provided by Easypaisa, enabling users to quickly access their transaction history with a simple code.

By dialing this code on their mobile device, users can view a summary of their recent financial activities conducted through the Easypaisa service.

This function is crucial for managing personal finances, tracking payments, and ensuring all transactions are accounted for.

It offers a straightforward method for users to verify their activity and maintain oversight of their funds without navigating through multiple menus or logging into an app.

The Significance of Tracking Your Transactions

Keeping an eye on your transactions is critical for financial health and security. By regularly reviewing your Easypaisa transaction history, you’re not only ensuring that all payments and transfers are correctly accounted for but also protecting yourself against unauthorized transactions.

This habit assists in identifying discrepancies early, making it easier to address any potential issues.

Additionally, tracking your transactions can help in budgeting and financial planning by giving you a clear view of where your money is going.

It’s an essential practice for anyone looking to maintain control over their finances and avoid surprises.

Step-by-Step Guide to Using the Transaction History Code

To access your Easypaisa transaction history using the code, follow these simple steps: First, ensure you have your mobile phone with the registered Easypaisa account number handy.

Open your phone’s dialer and enter the specific USSD code provided by Easypaisa for accessing transaction history (Note: This code can change, so refer to the latest guidance from Easypaisa). Press the call button.

You will receive a prompt asking you to confirm your request; follow the instructions provided. Shortly after, a summary of your recent transactions will be displayed on your screen or sent to you via SMS.

This quick access method is designed to make monitoring your financial activities both easy and convenient.

Tips for a Smooth Easypaisa Transaction History Experience

For a seamless experience with the Easypaisa Transaction History Code, keep your mobile software up to date to avoid compatibility issues.

Regularly check for updates on the Easypaisa app, as new versions often include improved features and bug fixes that enhance transaction history tracking.

Ensure your phone’s connection to the network is stable before attempting to access your transaction history to prevent any disruptions.

Also, familiarize yourself with the USSD menu options, as this can save time when navigating through services. Finally, consider setting up transaction alerts within the app to stay informed about your account activity without needing to check manually.

Troubleshooting Common Issues with Transaction History Access

If you encounter issues accessing your Easypaisa transaction history, try restarting your phone as a first step. This can resolve many basic software glitches.

If the problem persists, check your account balance to ensure you have sufficient funds, as some services may incur minimal charges.

Additionally, confirm that you’re using the correct USSD code for transaction history access; outdated or incorrect codes can lead to errors.

If issues continue, contact Easypaisa customer service for assistance. They can provide guidance and, if necessary, escalate the problem to technical support for a resolution.

Security Considerations When Accessing Transaction History

When accessing your Easypaisa transaction history, it’s paramount to prioritize security to protect your sensitive information.

Always ensure that you are using a secure and private internet connection to avoid potential data breaches.

Avoid accessing your financial information on public Wi-Fi networks where your data could be intercepted by malicious actors.

Furthermore, be cautious of phishing attempts; never share your Easypaisa PIN or password with anyone, and be wary of unsolicited messages or calls requesting personal information.

Regularly updating your app and mobile device’s security settings can also safeguard your transaction history from unauthorized access.

Future Developments and Enhancements in Easypaisa Services

Looking ahead, Easypaisa is committed to continually innovating and improving its services to meet the evolving needs of its users.

Anticipated advancements include the integration of more advanced security features to safeguard users’ financial information, the expansion of the merchant network for broader service usability, and the introduction of new financial products tailored to the diverse needs of Pakistani consumers.

Additionally, enhancements in user interface design are on the horizon, aimed at making the app even more intuitive and user-friendly.

Easypaisa’s dedication to leveraging technology for financial inclusion signifies exciting times ahead for its customers.

Alternatives to Using the Easypaisa Transaction History Code

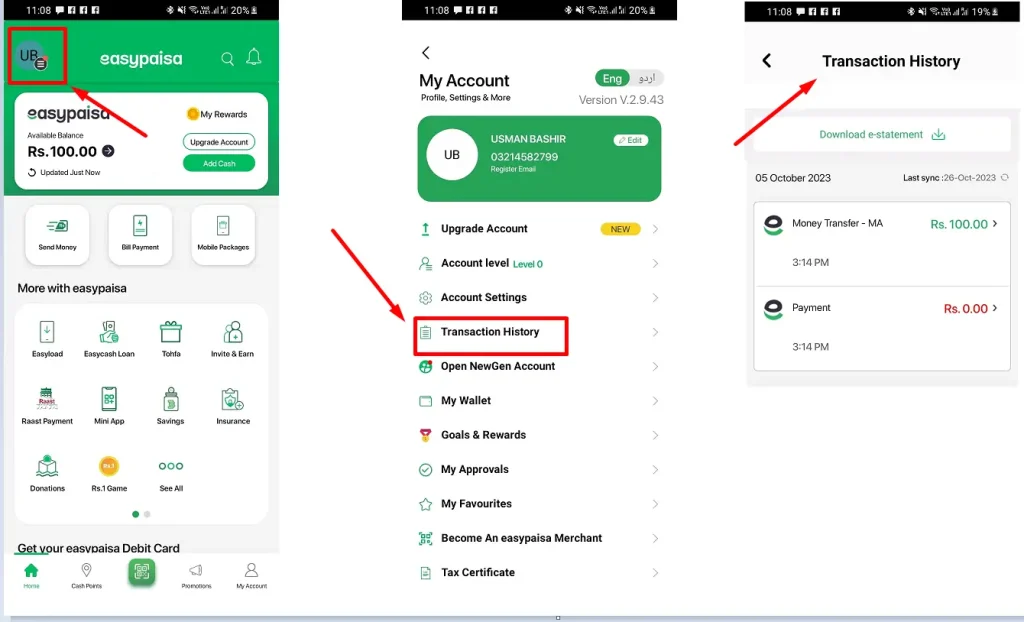

For those looking for alternatives to access their transaction history without using the USSD code, the Easypaisa mobile app offers a comprehensive and detailed view of all financial activities.

Users can easily log in to their account on the app to review their transaction history in a more visually engaging and detailed format.

Additionally, Easypaisa’s website provides an option to view transactions online, catering to users who prefer managing their finances through a browser.

These alternatives provide more flexibility and convenience for users to keep track of their financial transactions with Easypaisa.

How Easypaisa Stacks Up Against Other Mobile Financial Services

Easypaisa distinguishes itself from other mobile financial services through its wide-ranging functionality and user-centric approach.

Unlike many competitors, Easypaisa offers a comprehensive suite of services beyond just money transfers, including bill payments, mobile top-ups, and savings options, all accessible through a simple USSD code or an intuitive app interface.

Its extensive network of agents across Pakistan ensures ease of access for users in both urban and rural areas, a testament to its commitment to financial inclusion.

Additionally, Easypaisa’s innovative features, like the Transaction History Code, provide a level of convenience and security not always available in other services, positioning it as a leader in the mobile financial space.

User Testimonials and Success Stories

Across Pakistan, countless Easypaisa users have shared inspiring stories highlighting how the service has transformed their financial management.

One user recounted how the Transaction History Code helped them catch and rectify an unauthorized transaction swiftly, safeguarding their hard-earned money.

Another user praised Easypaisa for its ease of use, mentioning how it enabled them to seamlessly pay bills and send money to family in remote areas, fostering financial inclusivity.

These testimonials underscore the significant impact Easypaisa has had on simplifying personal finance, making it accessible and secure for everyone.

Frequently Asked Questions About Easypaisa Transaction History

How can I check my Easypaisa transaction history?

You can check your Easypaisa transaction history by logging into your Easypaisa account through the mobile app or website and navigating to the transaction history section.

Can I view detailed information about my transactions on Easypaisa?

Yes, the transaction history on Easypaisa provides detailed information such as transaction dates, amounts, sender/receiver details, and transaction statuses.

How far back can I view my Easypaisa transaction history?

Typically, you can view your Easypaisa transaction history for up to the last 30 to 90 days, depending on the service provider’s policy and your account type.

Is my Easypaisa transaction history secure?

Yes, Easypaisa employs secure encryption methods to protect transaction history data, ensuring confidentiality and privacy.

Can I download my Easypaisa transaction history for record-keeping?

Yes, Easypaisa often allows users to download transaction history reports in PDF format for record-keeping and auditing purposes.

Conclusion

In conclusion, Easypaisa provides convenient access to transaction history through its mobile app and website, offering users detailed insights into their financial activities.

With robust security measures in place, users can confidently monitor and manage their transactions, ensuring transparency and privacy in their financial interactions.